Contingent Workforce Solutions in 2026: How Enterprises Are Building Agile Talent Models

As we enter January 2026, the traditional corporate "headcount plan" is undergoing a quiet but radical retirement. For decades, the…

In today’s economy, the difference between growth and stagnation often comes down to one factor: how fast and how well you hire.

Board members no longer view recruitment as a back-office function. It’s a strategic investment, directly tied to revenue, innovation, and enterprise value. A misstep in talent acquisition can delay product launches, derail digital transformation programs, or inflate costs by millions.

But here’s the challenge: many HR teams struggle to frame these numbers in a way that resonates with executives. Recruiters may report “time-to-fill” in days, but boards want to hear “$2M in project revenue safeguarded.”

This blog unpacks the five recruitment KPIs every boardroom tracks closely, and shows how HR leaders can measure, benchmark, and present them in financial and strategic terms.

When CFOs open a hiring dashboard, this is the first number they scan—it’s the pulse of financial efficiency inside the talent engine. Cost-per-Hire (CPH) tells boards whether an organization is spending smart or simply spending.

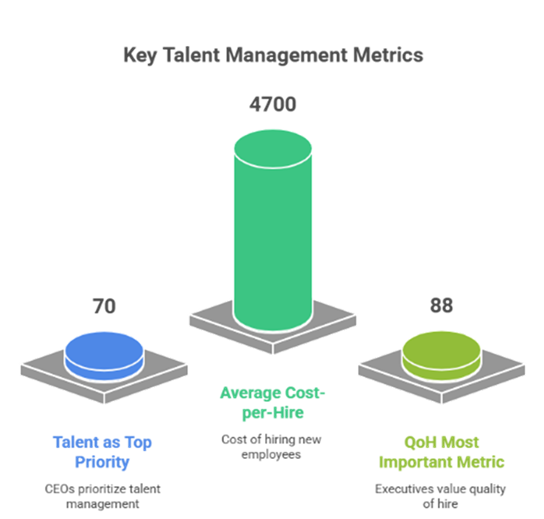

In a market where the average cost-per-hire is $4,700 (SHRM), that figure can easily triple when factoring in job-board ads, technology licenses, recruiter time, and onboarding overheads. Enterprises that monitor this metric tightly safeguard millions in workforce ROI.

The best-performing companies treat cost-per-hire not as a budget line but as a strategic lever—one that funds innovation and retention.

At Compunnel Talent Solutions, direct-sourcing frameworks and analytics-driven workforce models routinely help enterprises reduce CPH by 40–60 percent, converting savings into growth and engagement initiatives.

Every unfilled seat quietly costs revenue. Whether it’s a developer delaying a release or a sales rep missing a quarter, vacancies drain momentum.

Gartner (2025) pegs the average Time-to-Fill at 44 days, while IDC estimates each vacant day costs about $500 in lost productivity. Boards interpret faster hiring not as speed for its own sake, but as revenue protected.

Through AI-powered sourcing, automated outreach, and pre-vetted talent pools, Compunnel Talent Solutions helps clients cut TTF by 30–50 percent, ensuring business priorities never wait on hiring cycles.

Hiring fast gets headlines. Hiring right sustains performance.

Quality of Hire (QoH) is the measure boards trust most—it links talent decisions to long-term business outcomes.

LinkedIn Talent Trends (2025) found that 88 percent of executives rank QoH as their top hiring metric, because it reflects the real impact of recruiting on output, engagement, and retention.

Compunnel’s quality framework integrates structured assessments, AI-driven matching, and post-hire analytics to ensure shortlists align with business KPIs—not just job descriptions. The result: 14 percent higher first-year performance ratings and 25 percent improvement in retention versus transactional models.

Attrition is the silent leak in every workforce budget. Replacing employees who leave within a year costs up to 150 percent of their annual salary (Work Institute, 2025). Boards interpret high attrition not as HR failure but as capital erosion.

High first-year turnover often stems from poor onboarding or cultural misalignment. When corrected with analytics and structured engagement, retention becomes one of the most profitable KPIs in the talent portfolio.

At Compunnel Talent Solutions, data-led retention strategies and personalized onboarding frameworks help clients cut first-year attrition by 20–30 percent, protecting millions in rehiring and training costs.

Predictability is power. Healthy pipelines let boards sleep at night knowing critical roles, niche skills, and leadership transitions are already mapped and ready.

Deloitte Human Capital Trends (2025) reports that 60 percent of executives cite lack of pipeline visibility as a major business risk. Weak pipelines mean delayed projects, lost bids, and scrambling for talent in high-demand markets.

Through evergreen talent pools, AI-based sourcing, and proactive workforce mapping, Compunnel Talent Solutions helps clients maintain 3:1 candidate-to-role ratios across critical functions, ensuring business continuity, diversity, and readiness.

These five KPIs are no longer “HR numbers.” They are business-performance indicators that directly influence margins, agility, and shareholder confidence.

When HR leaders translate hiring data into financial language—dollars saved, revenue gained, risks mitigated—boards start listening.

With Compunnel Talent Solutions, organizations turn these metrics into measurable impact—building transparency, precision, and scalability across the entire hiring lifecycle.

Because when every metric speaks ROI, talent becomes the most accountable investment in the enterprise.

While the five KPIs above form the backbone of board reporting, forward-looking directors often probe secondary recruitment metrics to test the depth and resilience of HR reporting.

OAR=Offers AcceptedOffers Extended×100\text{OAR} = \frac{\text{Offers Accepted}}{\text{Offers Extended}} \times 100OAR=Offers ExtendedOffers Accepted×100

These supporting metrics provide contextual richness when boards drill deeper.

Executives pay attention to stories anchored in numbers. Here are 3 anonymized case snapshots that show how HR leaders have reframed recruitment KPIs for the boardroom.

Case 1: Global Bank – Time-to-Fill as a Revenue Driver

Case 2: Healthcare Network – Attrition as Financial Leakage

Case 3: Tech Enterprise – Pipeline Health as Risk Mitigation

Building a Board-Ready KPI Dashboard

Numbers only resonate when presented as concise, visual insights. Boards don’t want Excel dumps; they want dashboards that tie hiring metrics to outcomes.

Elements of a Board-Ready Dashboard

1. Financial Translation

2. Benchmarking Layer

3. Trend Visualization

4. Red/Green Signals

5. Executive Headlines

Compunnel Talent Solutions designs KPI intelligence dashboards that make hiring insights board-ready, blending financial proof, benchmark context, and executive storytelling.

Boards want insight, not just data. To translate KPIs into board-ready insights:

Example framing:

“Reducing cost-per-hire and time-to-fill by 20% freed $3.2M, which funded our DEI hiring program — strengthening both financials and ESG compliance.”

Future Outlook: The Next Era of Recruitment KPIs (2026–2028)

Recruitment KPIs are evolving. Over the next three years, boards will demand:

2. Skills-First Metrics

3. Diversity & ESG-Linked Metrics

4. Workforce Agility KPIs

Boards will also expect KPIs to be reported with the same rigor as financial statements — audited, consistent, and dollarized.

The five KPIs we’ve explored — cost-per-hire, time-to-fill, quality of hire, retention, and pipeline health — are no longer “HR metrics.” They are enterprise health indicators.

Boards want proof that talent strategy fuels business strategy. That every dollar invested in hiring returns multiples in growth, resilience, and continuity.

At Compunnel Talent Solutions, we help HR leaders transform these KPIs into evidence pipelines — data-driven insights that resonate with executives. From AI-native sourcing to compliance-first analytics, we enable enterprises to hire smarter, faster, and with measurable ROI.

Ready to make your recruitment KPIs boardroom-ready? Book a strategy session with Compunnel Talent Solutions.