You Do Not Need a Legal Entity to Own a Global Market. You Need This

The Incorporation Trap Has a Body Count It starts with ambition. A decision is made to enter a new market…

“One payroll mistake can undo months of employee goodwill.”

It sounds dramatic—but it’s the reality HR and finance leaders face every month. Payroll isn’t just a financial transaction. It’s the most visible promise an organization makes to its people: we will reward your work, fully and on time.

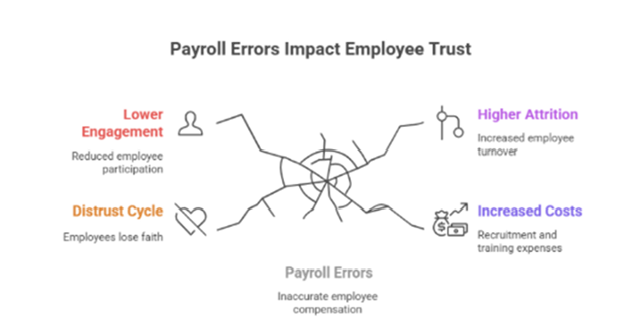

When that promise is broken—even once—the ripple effect is immediate and severe:

The stakes are staggering. According to ADP, employees who experience two or more payroll errors are twice as likely to leave within a year. SHRM estimates the cost of replacing an employee at 1.5–2x their salary. And on the compliance side, the IRS issued over $6 billion in payroll-related fines in 2023 alone.

In other words, payroll accuracy is not “back-office hygiene.” It’s a frontline trust-builder, a compliance shield, and a culture signal that shapes how employees see the organization—and how the market judges it.

This blog unpacks why payroll accuracy is a strategic imperative for HR, finance, and operations leaders; how errors undermine both people and profit; and how Compunnel Talent Solutions transforms payroll into a driver of trust, engagement, and organizational resilience.

For employees, payroll isn’t abstract about survival, security, and recognition.

When employees receive an accurate paycheck, it validates their contribution. When errors occur, the fallout is more than financial—it’s psychological. A SHRM study found that 49% of employees lose trust in their employer after a payroll error.

Mini-story: Priya, a marketing manager, receives her paycheck late for two consecutive months. Even though HR apologizes, her trust is fractured. Recruiters’ messages on LinkedIn suddenly feel like opportunities rather than interruptions. Within six weeks, she accepts another offer.

According to Gallup, financial stress is one of the top three causes of disengagement at work. Even a single payroll mistake can trigger anxiety and distract employees from their responsibilities.

When payroll is consistent, employees are free to focus on performance. When it isn’t, frustration becomes the dominant workplace emotion.

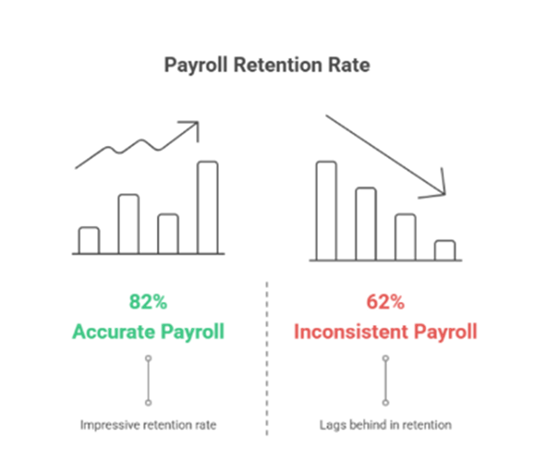

ADP research shows that employees who experience two or more payroll errors are twice as likely to resign within 12 months. In competitive markets, where replacing an employee costs 1.5–2x their annual salary (SHRM), payroll accuracy becomes a retention strategy.

Payroll errors don’t just hurt employees; they expose organizations to financial, operational, and reputational risks.

Payroll involves tax codes, benefits contributions, overtime rules, and classification laws. Errors can trigger penalties, audits, and legal battles. In 2023, the IRS issued over $6 billion in payroll-related fines.

Global businesses face even higher stakes. In Europe, GDPR requires precise handling of payroll data; in India, mismanagement of EPF/ESI deductions can lead to legal scrutiny.

Correcting payroll mistakes drains HR bandwidth. Deloitte estimates that HR teams spend up to 40% of their time addressing payroll errors, rather than focusing on strategic priorities such as talent development.

A single error often sets off a domino effect: recalculations, retroactive tax filings, communication with employees, and leadership escalation.

Employer branding isn’t just shaped by glossy recruitment campaigns. Platforms like Glassdoor and Indeed amplify negative experiences. A viral payroll complaint can erode an employer’s reputation overnight.

Mini-story: A mid-sized IT services firm misclassified 40 contractors as full-time employees. When the error surfaced, it led to delayed payments, union complaints, and a costly labor audit. The incident trended on social media, damaging their employer brand for years.

Payroll errors create a trust deficit cycle that spirals across the organization.

Mini-story: In a healthcare network, repeated payroll delays for nurses triggered union grievances. Beyond financial restitution, the organization suffered reduced patient satisfaction scores due to distracted and disengaged staff.

Data shows the transformational impact of payroll accuracy:

Retention Boost

Engagement Growth

HR Efficiency

Payroll is more than math. It’s a mirror of organizational values—played out not in lofty mission statements, but in the most practical, recurring interaction employees have with their employer: payday.

When payroll is accurate, it sends a silent but powerful message about what the company stands for:

This isn’t symbolic—it’s cultural. A Gallup study shows that employees who view their employer as “reliable and fair” are 4.3x more likely to stay. Payroll accuracy is one of the simplest, most visible ways to prove reliability and fairness in action.

Payroll and Inclusion

Errors in payroll aren’t equally felt. They disproportionately impact vulnerable groups:

When payroll fails these groups, it undermines broader equity and inclusion goals. In fact, PwC found that inconsistent payroll disproportionately contributes to financial stress for women and minority employees, widening existing inequalities.

Payroll as a Governance KPI

Forward-looking organizations are no longer treating payroll accuracy as HR hygiene. Boardrooms are starting to classify it as a governance KPI, alongside ESG and compliance indicators. Why? Because payroll precision is a quantifiable, recurring proof point of trustworthiness.

Companies that report on “trust-building actions” in their annual disclosures are increasingly adding payroll accuracy metrics—highlighting:

For CFOs and CHROs, this shift reframes payroll from “cost center” to culture signal—a direct link between financial stewardship, employee experience, and organizational reputation.

In short: Payroll accuracy is cultural currency. It demonstrates respect, reliability, and fairness daily, strengthens inclusion, and now carries weight as a boardroom-level trust metric.

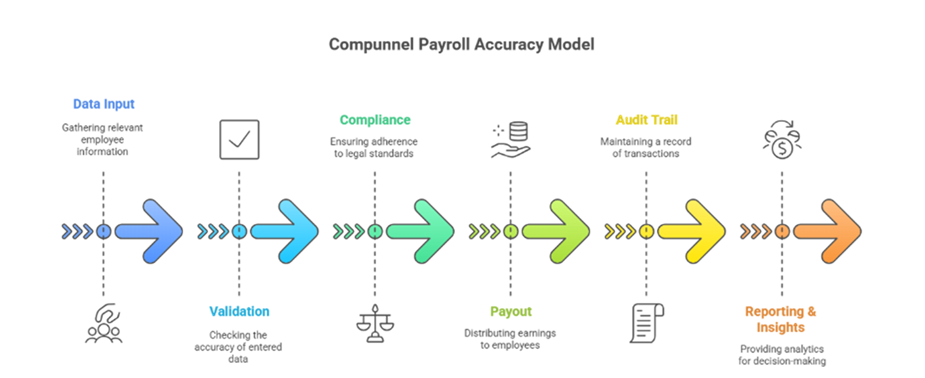

At Compunnel Talent Solutions, payroll precision is more than an operational metric—it’s an experience that builds lasting trust between employees and employers.

Together, these capabilities transform payroll from a back-office task into a trust engine that drives engagement, loyalty, and long-term retention.

Case Example: A Fortune 500 manufacturing client partnered with Compunnel to streamline payroll across five countries. Within a year, payroll error rates dropped from 3.2% to 0.2%, grievance tickets fell 60%, and HR capacity was freed to focus on workforce planning.

Payroll is evolving from a back-office function to a board-level strategy. The next frontier:

By 2026, experts predict payroll accuracy will no longer be viewed as HR hygiene—it will be a key trust indicator tracked by CFOs and CHROs.

Payroll isn’t paperwork. It’s proof. Proof that an organization keeps its promises, values its people, and runs with precision. Every on-time, accurate paycheck says, “We see you. We value you. We’ve got your back.”

But the opposite is just as true: one mistake can fracture months of trust, trigger disengagement, and fuel costly attrition. For employees, errors are personal; for leaders, they’re financial, legal, and reputational risks.

That’s why payroll accuracy belongs in the boardroom conversation—not as a back-office detail, but as a measurable driver of:

At talent acquisition solutions, we reframe payroll from an administrative cycle to a trust cycle. Our approach blends advanced technology, compliance-first rigor, and scalable delivery to ensure every paycheck is not just processed, but perfected.

Because when payroll runs flawlessly, employees don’t think about it. They think about growing, innovating, and staying. That’s where culture is built, and that’s where growth begins.

Partner with Compunnel Talent Solutions and turn payroll into your organization’s quietest, yet most powerful, driver of trust, loyalty, and long-term growth.