Security Posture Management (SPM) in the Cloud: How to Pick the Right One for Your Business

Cloud security is no joke—unless, of course, you enjoy compliance audits that feel like an interrogation scene from a crime…

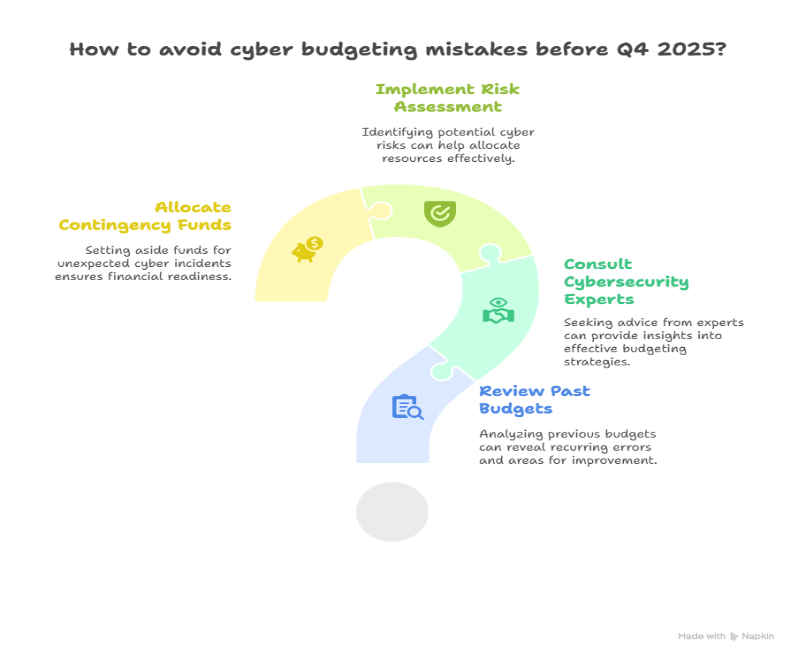

For CFOs, Q4 cybersecurity budgeting has started to feel less like financial planning and more like a fire drill. Budgets are rushed, approvals are frantic, and the focus shifts from strategy to survival. In 2025, nearly 60% of finance leaders admitted to overspending in Q4 just to avoid budget lapses, but that “use it or lose it” scramble often backfired. Compliance gaps were exposed, contracts went unused, and funds were funneled into tools with little impact.

The deeper issue wasn’t awareness. CFOs knew cyber risk was real, they just struggled to align budgets with the unpredictable way those risks surface. Treating cybersecurity as a year-end expense, rather than an ongoing investment in resilience, left enterprises exposed in ways no balance sheet captured.

As 2026 begins, the opportunity is clear: reframe cyber budgets as risk-weighted portfolios, benchmark them against exposure, and turn Q4 from a scramble into a strategy.

The Costly Oversights Finance Leaders Can’t Repeat

If 2025 taught finance leaders anything, it’s that many budget shocks weren’t caused by cybercriminals – they were caused by avoidable oversights. CFOs treated cyber as a fixed line item, and that narrow view created blind spots:

These weren’t intelligence failures; they were planning gaps. Cybersecurity was treated like a one-off expense, when in reality it behaves like a liability that compounds.

That story is not unique. Across industries, CFOs faced a cascade of avoidable surprises:

Notice the thread here? These weren’t failures of intelligence; they were failures of perspective. Cybersecurity was treated as a fixed expense, when it behaves more like a variable liability. Until CFOs reframe spend in terms of exposure avoided rather than tools purchased, the year-end scramble will keep repeating itself.

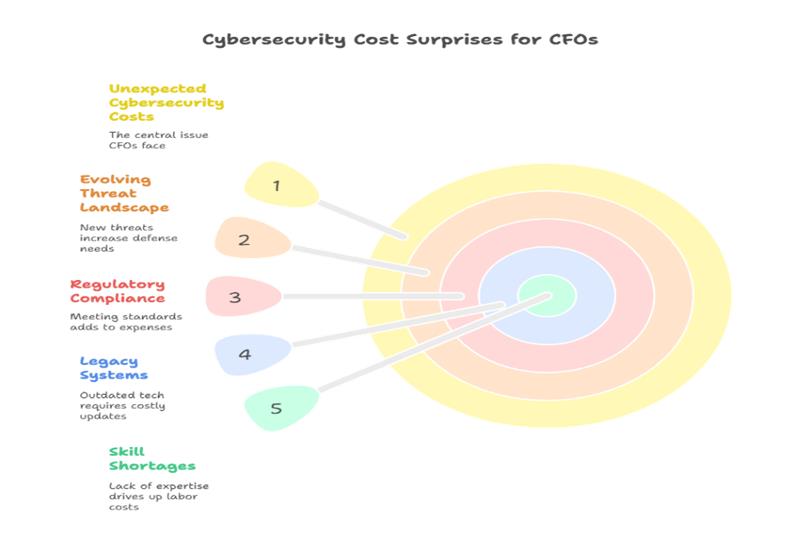

Why Cybersecurity Costs Keep Surprising CFOs

Even the most disciplined financial plans unraveled in 2025 because cyber costs simply don’t follow traditional budget cycles. Unlike fixed IT expenses, cybersecurity behaves more like a fluctuating market: it’s influenced by scarcity, regulation, and unpredictable shocks. The volatility is structural, not situational – and that’s why CFOs keep getting blindsided.

These aren’t simple oversights; they are embedded realities of modern cyber risk – a volatility curve CFOs can’t smooth out by spreadsheets alone. Which is why the mindset has to shift. Cybersecurity can’t be treated as a controllable IT expense. It must be managed like a volatile investment portfolio: diversified, scenario-tested, and weighted toward the assets where the cost of failure would be catastrophic.

The real pivot point comes when CFOs stop asking, “How much should we spend?” and start asking, “What’s the cost if we don’t?” That reframing transforms cyber from a sunk cost to a risk-weighted investment.

Consider the retailer that discovered its loyalty-program database represented billions in customer lifetime value. By quantifying what a breach would cost, lost revenue, legal exposure, reputational damage, the CFO could justify outsized investment in protecting that one asset, rather than spreading funds evenly across the IT landscape.

Other leaders are applying similar logic:

The takeaway? Cyber budgeting works best when it mirrors how CFOs already manage capital portfolios: diversified, scenario-tested, and weighted toward the most critical assets. Compliance might tell you what’s required. Risk modeling tells you what’s essential.

If financial oversight felt intense in 2025, 2026 raises the bar. The U.S. Securities and Exchange Commission (SEC) now requires public companies to disclose material cyber incidents within four business days – a deadline that leaves no room for improvisation. In Europe, the NIS2 Directive comes into enforcement in October 2024, with penalties extending into 2026. It expands liability beyond IT teams to corporate officers, holding leadership accountable for supply chain exposures and incident response readiness.

The consequence? Non-compliance isn’t just a regulatory fine – it’s a market signal. Investors now treat weak cyber disclosures as a proxy for poor governance, and stock prices have already shown sensitivity to breach announcements and reporting delays.

Forward-leaning CFOs are treating compliance not as a checkbox, but as an investment in trust capital. One multinational retailer implemented automated dashboards to continuously map controls to SEC and EU reporting requirements. The payoff? Audit prep time fell by 70%, fines were avoided, and investor confidence improved. In contrast, peers who delayed action had to carve out 10–15% of their budgets reactively just to catch up with regulators.

The connection is clear: in 2026, compliance is both a cost center and a confidence driver. Underfund it, and you risk not only penalties but erosion of shareholder trust — a hit that goes straight to market capitalization.

Here’s a final point many CFOs overlook: the biggest budget efficiencies don’t come from new tools; they come from better conversations.

In 2025, a logistics firm piloted quarterly joint planning between its CFO and CISO. Instead of arguing over headcount vs. technology, they ran breach simulations and translated every risk into a financial impact per day. That shift cut incident response costs by 30% in a single year.

This isn’t about being collaborative for collaboration’s sake. It’s about turning cyber into a shared financial language. CFOs bring risk-adjusted financial modeling; CISOs bring operational realities. Together, they can prioritize spend where it reduces exposure, rather than where it simply looks defensible on paper.

The real dividend? Predictability. Organizations that built CFO–CISO councils not only spent smarter, but they also reported higher board confidence in their cyber strategies. In volatile markets, that confidence is itself a form of currency.

What ties all of this together, oversights, volatility, risk-based reframing, regulatory shifts, and collaboration, is the need for CFOs to move from reactive to predictive. That’s where Compunnel comes in.

Our work with global enterprises shows that when budgets are mapped to exposure, when vendor ecosystems are optimized, and when compliance intelligence is embedded, CFOs gain both cost control and resilience. For some, that meant a 20% efficiency gain in vendor spend; for others, a 30% reduction in incident response costs. For all, it meant budgets that boards trusted.

If you’re planning your 2026 cyber budgets, Compunnel’s Cybersecurity and Cloud FinOps services can help you turn Q4 firefights into board-ready resilience.