Streamlining Mortgage BFSI Development: Navigating the Revolution with Azure DevOps

Introduction

The integration of Azure DevOps in the financial services sector has sparked a notable revolution in the BFSI industry, replacing traditional, siloed practices with modern, agile, and integrated systems, thus significantly benefiting the finance industry. Despite some initial reforms in the practices and procedures of the financial services industry at the beginning of the millennium, the sector exhibited reluctance and slowness in adopting new technologies such as Azure DevOps. Many entities within BFSI were hesitant to test these technologies, relying on their well-established traditional practices. Only after the proven safety, agility, and superiority of these new technologies over traditional ones did the adoption of Azure DevOps gain traction in the finance industry.

As the world continues its digital transformation, the financial services sector faces increasing pressure to meet evolving customer demands and expectations, exacerbated by competition from innovative fintech start-ups. These start-ups leverage revolutionary technologies to offer diverse services at a faster pace. Traditional financial services have recognized the urgent need for reformation, with the pandemic accelerating the sector’s transition into the digital age. In a scenario where physical contact is limited, and restrictions are imposed, financial institutions, especially banks, had to swiftly adapt to a new business model that ensures meeting customer needs and seamless operations.

Implementing Azure DevOps in the banking sector emerges as the most straightforward and secure approach to facilitate this paradigm shift. Azure DevOps has played a pivotal role in modernizing operations, benefiting both customers and the finance industry as a whole.

The Complexity of Mortgage BFSI Development

Mortgage BFSI projects are inherently intricate, involving a myriad of stakeholders, compliance intricacies, and intricate workflows.

Traditional development methodologies

These methodologies often result in fragmented processes, leading to slower development cycles, increased error rates, and challenges in seamless collaboration across teams and departments.

Siloed teams and complex workflows

Disparate teams working with different tools and processes lead to inefficiencies and delays.

Manual deployments and error-prone processes

Manual deployments are prone to errors and inconsistencies, leading to delays and compliance risks.

Limited visibility and traceability

Lack of visibility into the development process makes it difficult to track progress, identify bottlenecks, and ensure compliance.

Enter Azure DevOps, a comprehensive suite of tools designed to address these challenges by seamlessly orchestrating the entire software development lifecycle.

Unleashing Collaboration with Azure Boards and Repos

Azure DevOps begins the transformative journey right from the project’s inception. Azure Boards acts as a centralized hub for agile project management, offering an environment where teams can plan, track, and discuss work collaboratively across the organization. Whether following Scrum or Kanban methodologies, mortgage BFSI teams can tailor their workflows to align with the specific demands of their projects.

Complementing Azure Boards, Azure Repos provides a robust version control system, ensuring that source code is managed efficiently. Developers can collaborate seamlessly on the same project, ensuring version control, code quality, and compliance with regulatory standards.

Automated Pipelines for Effortless Deployment

Automation is a cornerstone of efficient development, and Azure DevOps excels in this domain with its Azure Pipelines. In the realm of mortgage BFSI, where precision and compliance are non-negotiable, automated pipelines reduce deployment risks and ensure a consistent, repeatable deployment process.

Developers can define their release processes through YAML or visual designer interfaces, encompassing tests, approvals, and targeted deployments. This level of automation not only accelerates the development cycle but also ensures that mortgage applications adhere to the stringent requirements of regulatory bodies.

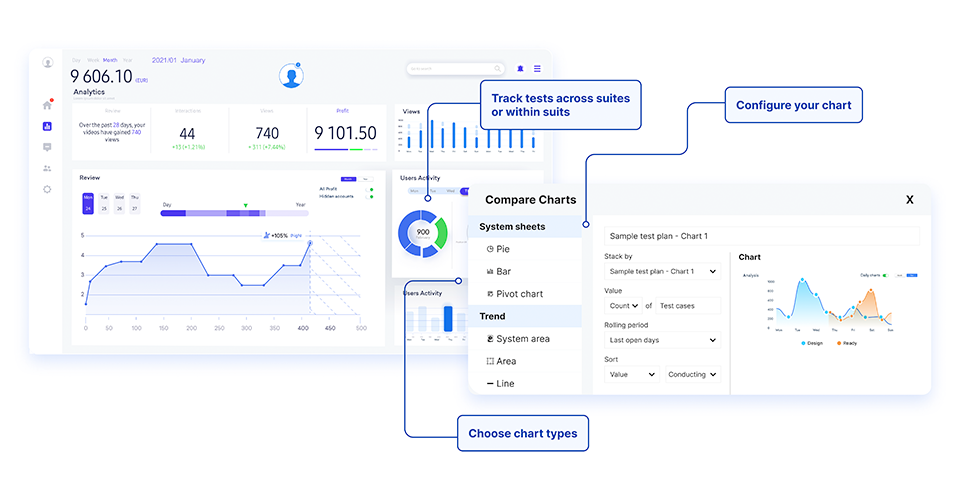

Continuous Feedback with Azure Test Plans

Quality assurance is paramount in mortgage BFSI projects, and Azure Test Plans offer a robust solution for continuous testing. Teams can create, manage, and run tests for their applications, ensuring that ever y update or feature aligns with the highest standards.

y update or feature aligns with the highest standards.

Integrated feedback mechanisms provide insights into application performance and user experience, fostering a culture of continuous improvement. This not only accelerates the development cycle but also ensures that mortgage applications are resilient, secure, and user-friendly.

Secure and Compliant Development

The financial services sector is arguably the largest industry with a high volume of daily transactions. Security stands out as the utmost priority, necessitating compliance with various security regulations and standards. This reluctance towards initial digital transformation is a significant challenge faced by financial institutions, despite assurances from providers of Azure DevOps services.

For those financial services enterprises that took the step to adop t Azure DevOps, tangible benefits have emerged. The adoption has proven effective in proactively mitigating potential security issues by identifying threats early and addressing them promptly. Additionally, the introduction of SecOps with Azure DevOps, seamlessly integrates a comprehensive security process into the system lifecycle. This development has further fortified the foundation for the widespread adoption of Azure DevOps within the financial services industry.

t Azure DevOps, tangible benefits have emerged. The adoption has proven effective in proactively mitigating potential security issues by identifying threats early and addressing them promptly. Additionally, the introduction of SecOps with Azure DevOps, seamlessly integrates a comprehensive security process into the system lifecycle. This development has further fortified the foundation for the widespread adoption of Azure DevOps within the financial services industry.

Case Studies

Several mortgage lenders have successfully implemented Azure DevOps to streamline their development processes. For example, one of the leading financial institute reduced development time by 30% and improved application quality by 20% after adopting Azure DevOps.

Getting Started with Azure DevOps

If you’re a mortgage lender looking to streamline your development processes, Azure DevOps is a powerful solution. Here are some steps to get started:

- Assess your current development process: Identify pain points and areas for improvement.

- Define your goals and objectives: What do you want to achieve with Azure DevOps?

- Choose the right tools and services: Azure DevOps offers a wide range of tools and services to meet your specific needs.

- Start small and scale gradually: Begin by implementing Azure DevOps for a small project and gradually expand to your entire development process.

- Seek expert guidance: Partner with a qualified Azure DevOps consultant to help you implement and optimize your development process.

Conclusion: Transforming Mortgage BFSI Development

The adoption of Azure DevOps is catalyzing a paradigm shift in mortgage BFSI development. By integrating collaboration, automation, and compliance into a unified platform, Azure DevOps empowers teams to accelerate their development cycles, enhance application quality, and meet the ever-evolving demands of the BFSI sector.

As mortgage providers navigate a landscape of changing regulations and customer expectations, embracing Azure DevOps becomes not just a choice but a strategic imperative. The revolution is underway, and those who leverage the power of Azure DevOps are poised to lead the way in streamlining mortgage BFSI development for a more secure, efficient, and customer-centric future. In this era of digital transformation, Azure DevOps stands as a beacon, guiding the BFSI sector towards a new horizon of innovation and operational excellence.

To know more, Click here.

Author: Kirankumar Talawai( Director – Cloud Practices at Compunnel)