Building the Bridge Between IT and Operations in Mortgage BFSI with DevOps

Mortgage BFSI: From Siloed Struggle to DevOps Dream Team

Imagine a bustling mortgage marketplace, abuzz with activity. Customers demand lightning-fast approvals, seamless digital journeys, and innovative solutions. But behind the scenes, two teams – IT, the innovation engine, and Operations, the stability anchor – fight their own silent battle. Siloed information, misaligned priorities, and communication gaps create friction, slowing progress and hindering customer satisfaction.

The Pain Points: Why IT and Operations Struggle in Mortgage BFSI

Before delving into the solutions, let’s understand the root of the problem. Traditional IT and operations departments in mortgage BFSI often face numerous challenges that hinder efficiency and customer satisfaction:

- Silos and Misalignment: IT and operations function in separate silos, with different priorities, processes, and communication channels. This leads to inefficiencies, delays, and finger-pointing when issues arise.

- Manual Processes: Repetitive, manual tasks plague both IT and operations, leading to human error, inconsistencies, and wasted time.

- Lack of Automation: Limited automation across application development, deployment, and infrastructure management creates bottlenecks and restricts agility.

- Reactive Approach: Teams react to problems instead of proactively preventing them, leading to downtime and disruptions.

- Security Concerns: Fragmented security practices across different teams increase vulnerabilities and compliance risks.

These challenges translate to real-world consequences:

- Slow Loan Processing: Customers face delays and frustrations due to lengthy loan approval processes.

- Inaccurate Data: Manual data entry and lack of integration lead to errors and inconsistencies, impacting decision-making.

- Compliance Issues: Non-compliance with regulations due to siloed processes and fragmented security can result in hefty fines and reputational damage.

- Poor Customer Experience: Inconsistent communication and lack of transparency create a frustrating experience for customers.

The DevOps Solution: Building the Bridge to Success

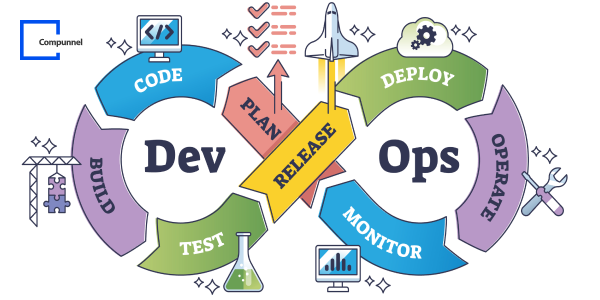

DevOps is not just a technology; it’s a cultural and methodological shift that fosters collaboration, automation, and continuous improvement between IT and operations. Here’s how it addresses the pain points mentioned earlier:

- Breaking Down Silos: DevOps promotes cross-functional teams with shared goals and accountability, fostering communication and collaboration.

- Embracing Automation: Automate repetitive tasks across the entire loan lifecycle, from application processing to document management, using CI/CD pipelines and infrastructure automation tools.

- Proactive Approach: DevOps encourages continuous monitoring and feedback loops to identify and fix issues before they impact customers.

- Enhanced Security: Integrate security practices throughout the development and operations lifecycle, ensuring compliance and reducing vulnerabilities.

The Benefits of DevOps in Mortgage BFSI

By implementing DevOps principles, mortgage lenders can unlock a plethora of benefits:

- Faster Loan Processing: Automate tasks and streamline workflows to significantly reduce loan processing times, improving customer satisfaction.

- Reduced Costs: Eliminate manual processes and optimize resource allocation, leading to cost savings.

- Improved Data Accuracy: Automate data capture and integration to ensure data accuracy and consistency, leading to better decision-making.

- Enhanced Compliance: Automate compliance checks and reporting, reducing the risk of non-compliance issues.

- Increased Innovation: DevOps foster a culture of experimentation and continuous improvement, leading to faster innovation and new product development.

Building Your DevOps Bridge: A Step-by-Step Guide

Implementing DevOps in your mortgage BFSI organization requires careful planning and execution. Here’s a roadmap to guide you:

- Assess Your Current State: Analyze your current IT and operations processes, identify pain points, and understand team structures and communication channels.

- Define Your Goals and Objectives: Clearly define what you want to achieve with DevOps, such as faster loan processing, improved customer experience, or cost reduction.

- Build Your Team: Create cross-functional teams with representatives from IT, operations, security, and compliance departments.

- Select Your Tools and Technologies: Choose DevOps tools that align with your needs and budget, such as CI/CD platforms, infrastructure automation tools, and collaboration platforms.

- Implement DevOps Practices: Start small and gradually implement DevOps practices like continuous integration, continuous delivery, and infrastructure as code.

- Measure and Monitor Progress: Track key metrics like loan processing times, customer satisfaction scores, and compliance adherence to measure the impact of DevOps.

- Foster a Culture of Collaboration: Encourage open communication, shared ownership, and continuous learning

The DevOps arsenal

- Common platform: No more fragmented data, no more confusion. It’s a unified battleground where everyone speaks the same language and fights for the same goals.

- Automation brigade: Tireless bots handle the mundane, freeing up IT for innovation and Operations for strategic oversight. Think of it as deploying intelligent assistants for both teams.

- CI/CD pipeline: Like a secure conveyor belt, it delivers new features swiftly and safely, ensuring quality and minimizing risks.

- Metrics dashboard: A real-time war room, but instead of battle plans, it displays performance, compliance, and customer satisfaction metrics, allowing for proactive problem-solving

The transformation roadmap:

- Start small, scale gradually: Don’t try to conquer the entire landscape at once. Pick a pilot project, build trust, and then expand your territory.

- Collaboration is key:It’s not about IT winning or Operations winning, it’s about the mortgage dream team winning. Break down silos, encourage open communication, and celebrate each other’s successes.

- Metrics are your compass: Track progress, identify roadblocks, and adapt your strategy based on data-driven insights.

The future is bright:

By embracing DevOps, you’re not just building bridges, you’re building a winning team. Imagine faster time-to-market, reduced costs, improved compliance, and most importantly, happy customers. So, join the DevOps revolution, rewrite the story of your mortgage BFSI organization, and watch your business soar to new heights.

Remember:It’s not about winning a war, it’s about building a winning future, together.

To know more, Click here.

Author: Kirankumar Talawai( Director – Cloud Practices at Compunnel)